Six years after Blue Apron, Hello Fresh and Plated first launched in the U.S. and carved-out their own niche, supermarket retailers are finally jumping on board offering their own branded kits or acquiring meal kit companies. That’s because consumers are increasingly seeking both fresh and convenient solutions for meal planning.

Estimated Size of the Meal Kit Market

Packaged Facts put meal kit revenue at $5 billion last year. According to a Nielson report, meal kit spending is rising three times faster than digital delivery or e-grocery. The report states:

- 9% of consumers (10.5 million households) have purchased a meal kit in the past six months

- 25% said they would consider trying one in the next six months, representing more than 30 million potential household customers

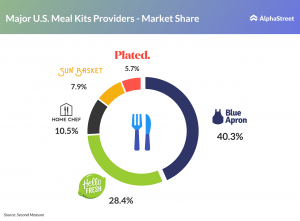

But a study by Second Measure finds that meal-kit companies themselves are losing subscribers as the market for meal kits becomes over saturated. Although Blue Apron has struggled the past few years, Hello Fresh’s revenue increased 70% in 2017. Statistics portal Statista says meal kits generated $1 billion in revenue worldwide in 2015 and will hit $10 billion by 2020.

Retailer’s Acquire Meal Kit Providers

After acquiring Plated last year, Albertsons will be carrying meal kits in hundreds of its stores nationwide this year. Kroger Co. followed suit and announced the acquisition of Home Chef in May, 2018 for $200 million. This past October, Kroger began rolling out meal kits in select markets with plans to expand the retail distribution of Home Chef meal kits to more markets this year.

Nielsen reports that in 2017 in-store meal kits generated $154.6 million in sales, posting growth of more than 26% year-over-year. For context, total brick-and-mortar sales for center store edibles (grocery, dairy, frozen foods) dipped 0.1% last year. Albertson’s claims that 80 percent of their customers would like to see meal kits available in stores.

Retailers Roll Out their Own Brand of Meal Kits

Using their already popular “Apron’s” brand, Publix began to roll out its own line of meal kits in 2017. Over the years, Publix has grown their Apron’s program that features culinary education through recipe cards, in-store demonstrations and cooking schools. This program provides a natural extension to offering meal kits. Additional themed kits include slow cooker and grilling options.

Walmart began rolling out its own branded meal kits in March, 2018. The pre-proportioned kits are designed to serve two people and priced between $8 to $15. In addition, Walmart will also offer ready-to-heat meals that are more heavily meat based.

What Does this Meal-Kit Mania Mean?

Only time will tell if the meal kit market becomes over saturated or remains profita ble. But what is not likely to change is consumers’ desire for both freshness and convenience.

ble. But what is not likely to change is consumers’ desire for both freshness and convenience.

Suppliers have the opportunity to develop a partnership with retailers and/or meal kit companies to include their product in the kits. As an example, Smithfield Foods partnered with Chef’d in 2018 to bring meal kits to grocery stores and these are now available in 27 states at more than a dozen retailers, including Costco, Hy-Vee, Harris Teeter, Tops, Weis and Gelson’s Markets.

Like Smithfield has done, suppliers have the option of getting ahead of trends like these as the retail marketplace continues to adapt to changing times.